424. Risk aversion versus loss aversion, part 2

Risk aversion and loss aversion are two theories of how people make decisions under risk. Is loss aversion the superior theory, as some have claimed? In the context of decision making on a large commercial farm, I am not so sure.

I’ll repeat my warning that, like the previous PD423, this one is a bit more technical and probably less practically relevant than the other posts in this RiskWi$e series. If you find it too abstract, feel free to skip it. Reading PD423 first will help you understand this post.

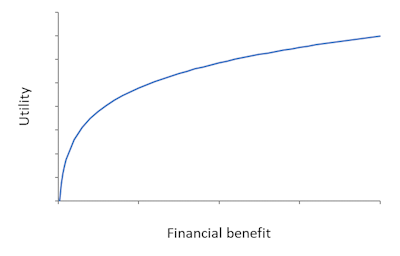

The traditional theory of risk aversion (underpinned by the utility curve in Figure 1) represents an idealised form of rational decision making. Its strengths include that it has highly logical underpinnings, and that it captures the essential feature of decision making by risk-averse people: they give more weight to relatively bad outcomes than to relatively good outcomes.

On the other hand, it has long been known that most people deviate from the traditional theory in various ways. For example, when comparing decision options, if the probabilities attached to various outcomes from those options are changed, people don’t necessarily modify their decisions in a logically consistent way (e.g., “the Allais Paradox“).

Various modified versions of the theory have been developed to try to better represent the decisions of real people. These include John Quiggin’s Rank-Dependent Utility and Kahneman and Tversky’s Prospect Theory (including loss aversion).

Despite the availability of other supposedly better theories, the traditional theory has continued to be widely used in economics, including in agricultural economics. One probable reason is that it is easier to include the traditional theory in quantitative economic models, but is this sacrificing accuracy for the sake of convenience? Barberis (2013) wrote that “prospect theory is still widely viewed as the best available description of how people evaluate risk in experimental settings”. But how about real-world settings, like managing a large commercial farm?

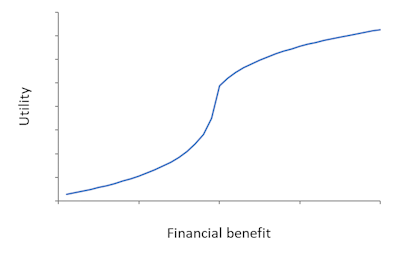

According to the theory of loss aversion, people evaluate a decision by considering its possible outcomes relative to a reference point. It says that when making decisions, there is a sharp difference in the weight given to outcomes better than and worse than that reference point, with bad outcomes looming a lot larger in peoples’ minds. That’s why there is a corner in Figure 2 – it’s the reference point. The rapid fall to the left of the reference point indicates that small losses make a big difference to the decision maker’s utility.

In a new publication, researchers look at 607 empirical estimates of loss aversion from 150 research articles (Brown et al. 2024). They found that, on average, people in the studies gave about twice as much weight to losses as to equivalent gains. A field study looking specifically at French farmers (Bougherara et al. 2017) found that they cared about losses about 1.4 times as much as they cared about gains.

That all seems quite compelling, but unfortunately things are not quite that neat and tidy. Gal and Rucker (2018), in a paper provocatively and wittily titled “The loss of loss aversion: Will it loom larger than its gain?”, presents various pieces of evidence showing that people are not necessarily loss-averse, or at least not always. For example, …

“Arguably, perhaps the most straightforward test of loss aversion is to simply ask people to evaluate the impact of losing versus gaining the same object. However, when researchers have examined how people rate the impact of losing versus gaining the same amount of money, little support for loss aversion has emerged”. (Gal and Rucker, 2018, p. 507)

They give quite a few examples like this, and conclude quite strongly that loss aversion is not a general phenomenon (as you can tell from the title of their article). I found the article interesting and persuasive. For a deeper dive that is quite readable, see this blog post by Jason Collins.

I’ll leave the specialists to fight out that battle, but I have some doubts of my own about how relevant loss aversion is to practical agriculture. All of the research studies of loss aversion I’ve looked at (including the one with French farmers) involve gains and losses that are tiny compared with what farmers face from year to year. If farmers weighted their business ups and down as differently as the loss-aversion research suggests, they would be extremely risk-averse in their decision making. But this clearly is not the case for most commercial farmers in developed countries. As I’ve said previously, the evidence is that most farmers are risk-averse, but not very risk-averse. If the commonly measured degree of loss aversion applied to all of the business ups and downs experienced by farmers, nobody would be willing to be a farmer — they would move to less risky occupations.

What about the implication of Prospect Theory that we should see risk-seeking behaviour if all of the possible outcomes are worse than the reference point? Assuming that a farmer’s reference point is something like an average production year, Prospect Theory suggests that farmers in the midst of a bad production year will behave in a risk-seeking way. They will go for unlikely gains even if it puts them at greater risk of achieving poorer outcomes. But in reality, if conditions are bad, farmers don’t do things that increase their risks; they don’t increase input rates or plant more risky crops. They do the opposite; if it’s not too late, they cut back their inputs and reduce the area of relatively risky crops. (That is probably more about going for the strategy that will maximise expected returns than anything to do with risk, but we can at least say that any tendency towards risk seeking is not evident in the behaviour of most farmers, even in a drought.)

My conclusion from all this is that, at least for commercial-scale farmers in developed countries, loss aversion and Prospect Theory are not the breakthroughs in understanding risk attitudes that some have claimed. The traditional theory of risk aversion has limitations as a description of what people really do, but from my observations of farmers’ decision making, it seems to be a better approximation of agricultural reality than loss aversion or the risk-seeking component of Prospect Theory.

Further reading

Barberis, N.C. (2013). Thirty years of prospect theory in economics: A review and assessment, Journal of Economic Perspectives 27(1), 173-196.

Bougherara, D., Gassmann, X., Piet, L., and Reynaud, A. (2017). Structural estimation of farmers’ risk and ambiguity preferences: a field experiment, European Review of Agricultural Economics 44(5), 782–808.

Brown, A.L., Imai, T., Vieider, F.M. and Camerer, C.F. (2024). Meta-analysis of empirical estimates of loss aversion, Journal of Economic Literature 62(2), 485–516.

Gal, D. and Rucker, D.D. (2018). The loss of loss aversion: Will it loom larger than its gain? Journal of Consumer Psychology 28(3), 497-516.

This is #17 in my RiskWi$e series. Read about RiskWi$e here or here.

The RiskWi$e series:

405. Risk in Australian grain farming

406. Risk means probability distributions

408. Farmers’ risk perceptions

409. Farmers’ risk preferences

410. Strategic decisions, tactical decisions and risk

412. Risk aversion and fertiliser decisions

413. Diversification to reduce risk

414. Intuitive versus analytical thinking about risk

415. Learning about the riskiness of a new farming practice

416. Neglecting the risks of a project

418. Hedging to reduce crop price risk

419. Risk premium

420. Systematic decision making under risk

421. Risk versus uncertainty

422. Risky farm decision making as a social process

423. Risk aversion versus loss aversion, part 1

424. Risk aversion versus loss aversion, part 2 (this post)

433. Depicting risk in graphs for farmers

These modules are meaningful for me in my journey of studying Agribusiness. Thank you for sharing me these modules.

Hi David,

Agriculture Commodity Farmer who entered in Marketing Contract and Production Contract for hedge the commodity price risk for Agri Commodity- Corn, Soybean, Wheat, Cotton, Canola etc.

How the Agri commodity Farmer track and analyze the daily Mark to Market (MtM) Margin in Hedge instrument( Commodity future/Option etc.)

good information

Regard from Unissula

ari awan – https://unissula.ac.id/